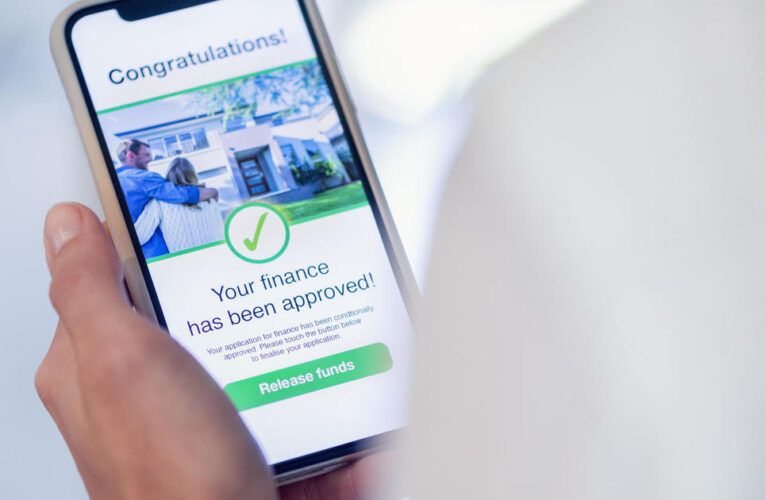

6 HELOC borrowing mistakes to avoid this December

We may receive commissions from some links to products on this page. Promotions are subject to availability and retailer terms. A HELOC could make sense this December, but you’ll want to avoid some costly mistakes if you take this route. TEERAYUT CHAISARN/Getty Images As the holiday season approaches and year-end expenses loom, many homeowners are considering tapping into their home equity with a home equity loan or a home equity line of credit (HELOC). That can be a smart plan, especially right now, considering that these borrowing options typically have some of the lowest rates available — and that the average homeowner has about $319,000 worth of home equity to tap into. But while home equity loans and HELOCs are both worth considering, HELOCs, in particular, can be an attractive option for accessing your home’s equity in today’s market. With a HELOC, you get low average rates and access to a line of credit that can be borrowed from multiple times (up to the limit), offering you more flexibility than you’d get with a lump-sum home equity loan. However, the decision to borrow against your